A way out of cheap money

by Marketing Team

One record chases the other

The bull market in the first months of 2021 at the latest should have made it clear to most critics of Bitcoin that this is not a short-term hype, fueled by peoplewho want to revolutionize the payment system, but an idea that can no longer be ignored. With the addition of other flagships such as Microstrategy and Tesla, or even the recent IPO of Coinbase, the entrepreneurial and financial world is now also increasingly interested in the digital gold, which contributes partly to push up the prices of cryptocurrencies.To understand the interest in cryptocurrencies, it is worth taking a look at the current monetary system, which is currently being put to the test, especially by cheap money. Whether it’s Bitcoin, Ether, XRP, or a crowd-influenced token such as Dogecoin, cryptocurrencies offer one thing above all else: a way out.

Is the economy addicted to cheap money?

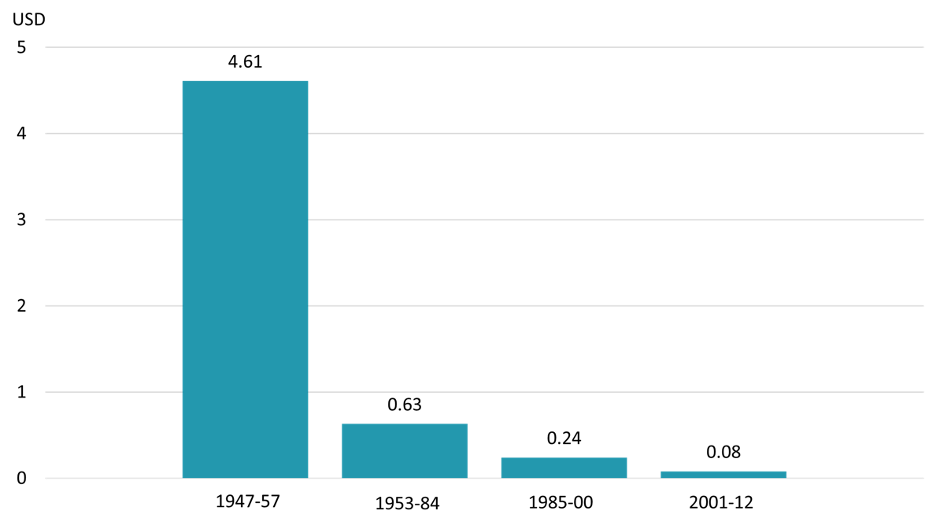

The major industrialized nations are based on a fiat money system that, by definition, allows central banks to create money out of thin air. Among other things, this system offers the advantage of controlling the money supply to a certain extent. This is especially important in times of economic downturns, as the Fed in the U.S. and the ECB in the Eurozone are currently doing to counteractthe economic downturns caused by the ongoing COVID-19 chaos. This newly created money is intended to stimulate the economy and encourage both individuals and businesses to increase consumption and investment. Historically, this approach has made consistent sense, emanating from the United States: Looking at Figure 1, one can see that, in simplified terms, every single U.S. dollar of new debt raised generated well over $4 of GDP in the period from 1947-52. However, 50 years later, in the mid-2000s, each U.S. dollar of newdebt embodies only $0.08 of GDP growth. This effect of diminishing marginal utility may be a short-term success, but it has a long-term negative impact on the monetary system. The constant expansion of the money supply, extensive stimulus packages and low-interest-rate policies have created a cycle that is increasingly difficult to discontinue, as a sudden end to the provision of liquidity or an increase in interest rates would likely lead to greater turmoil in the economy.

High inflation is no solution either

The resulting problem is a potential excess of inflation. Common definitions of inflation are mostly limited to the resulting symptoms but leave out the fundamental causes. However, this only looks at one side of the equation and omits the underlying reasons for the growth rate of inflation, confusing the effect with the cause, which is primarily due to excessively expansionary monetary policy.

In addition to the effect of increasing price levels, there is also a redistribution of wealth. According to the Cantillon effect, the beneficiaries of new money after a monetary expansion are those who receive it first. Those can continue to use it at the old price level, and only after the money begins to circulate in the economy are prices gradually corrected.

„My own personal view is that inflation is neither desirable nor necessary, that the most effective road to development is through free enterprise and private investment, and that the government can serve best by limiting itself to essential government functions, keeping taxes of all kinds low, refraining from intervention into the economy, and providing a stable monetary framework. “- Milton Friedman (1971)

Hard currencies in challenging times

With many of the established cryptocurrencies taking a deflationary approach, the money supply cannot be arbitrarily determined, making them a harder currency. While Bitcoin’s original idea of a purely peer-to-peer electronic payment system is not currently enabled with uneconomic transaction fees, or limited transaction volume, Bitcoin and other cryptocurrencies still offer a way out of the excessive money creation process, and it remains to be seen how investors will react to further actions by central banks and political activities.

Blocksize Capital’s solutions simplify the access to cryptocurrencies, especially for institutional investors, and therefore offer an opportunity to invest in harder currencies and add another asset class to the portfolio to protect oneself against a potential excess of inflation.

This information is subject to change at any time, based upon economic, market and other considerations and should not be construed as a recommendation.

Written by Felix Novotny, Sales Assistant at Blocksize Capital GmbH

Sources:

Ammous, S. (2018). The Bitcoin Standard: The Decentralized Alternative to Central Banking. New Jersey: John Wiley & Sons.

Dewk, E. (2020). Have Markets Become Addicted to Stimulus?

Easterly, W., & Fischer, S. (2000). Inflation and the Poor. Washington: The World Bank.

Friedman, M. (1971). Government revenue from inflation. Journal of Political Economy, 846-856.

Johnson, H. G. (1968). Current Issues in Monetary Policy. Financial Analysts Journal, 87-153.

Morton, W. (1951). Keynesianism and Inflation. Journal of Political Economy, 258-265.

Rothbard, M. N. (2000). America’s Great Depression. Auburn: The Ludwig von Mises Institute.

Stöferle, R.-P., & Valek, M. (2013). In GOLD we TRUST -Extended Version. Vaduz: Incrementum AG.

Stöferle, R.-P., & Valek, M. (2020). The Boy Who Cried Wolf: Is An Inflationary Decade Ahead? Schaan: Incrementum AG.

Taghizadegan, R., Stöferle, R., Valek, M., & Blasnik, H. (2015). Austrian School for Investors: Austrian Investing between Inflation and Deflation. Vienna: mises.at.