Bitcoin 2021 = Internet 1997

by Marketing Team

„You are still early to get into crypto and buy Bitcoin!” – this is a commonly found commentary under a crypto-related thread or a phrase that is overheard in a conversation quite often. But how early are you really?

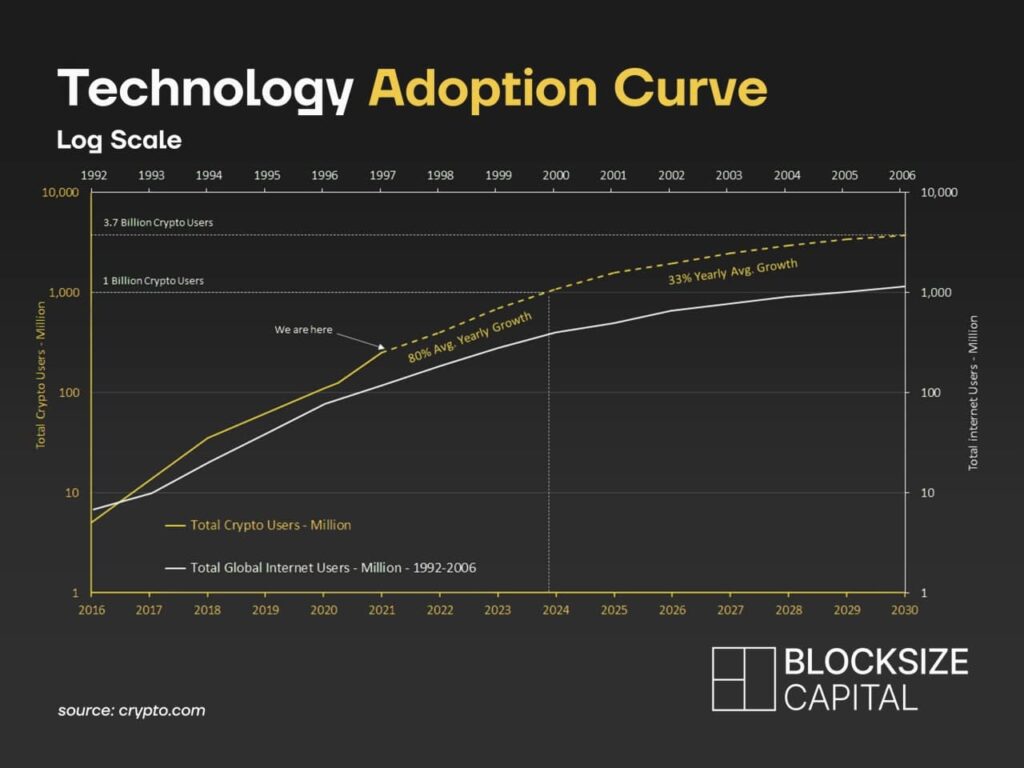

For some of us, it would be enough to throw around some numbers like “more than 100 million people” or “roughly 1.3% of the world’s population” own Bitcoin. But most of us prefer a more tangible approach – something relatable from the past – in order to get a clearer picture. For this purpose, it might be useful to compare the case of Bitcoin to the Internet. With this analogy in mind, it will suddenly become easier to grasp how early it still actually is. The userbase of Bitcoin in 2021 equals the userbase of the Internet in 1997.

Yes, 1997! When computers used to look like the one in the image above, when Google didn’t even exist and the development of the Internet was still at the outset. In case you belong to the millennial generation, you might recall this time period very well and possibly reminisce often about the nostalgic sound of your modem trying to connect to the World-Wide-Web for only a few minutes online. Now, look around you and observe how far we have come in 2021. The phone in your pocket or even the watch on your wrist is discernibly more powerful than any personal computer in 1997; and many of the electronics surrounding you are online around the clock and are becoming a part of the rapidly growing Internet of Things landscape. The Internet has come a long way by crossing the vital threshold of 100 million users in 1997, to more than 1.37 billion after 10 years in 2007. This marked a 10X growth in just one decade and resulted in 4.66 billion users today.

Comparing Bitcoin to the Internet makes additional sense from a technical point of view, as the underlying blockchain technology of the Bitcoin network is being referred to as the Web 3. This marks the new era of the World Wide Web. Web 1, just like in 1997 used to be a one-directional flow of information or data, out of the network to the user, followed by Web 2, where copies of information or data could be provided and shared by a user with the network using centralized services. Web 3, being based on blockchain technology now enables a data structure that holds transactional records while ensuring security, transparency, and decentralization.

Thus, Bitcoin and the entire blockchain environment seem to be following the footsteps of the Internet, and this is marking the new era. But can it reach the historic tenfold growth of the Internet in the next decade?

Bitcoin: An Exponential Growth Story

If we look at the global cryptocurrency market capitalization, it was a little more than $151 billion on 15th March 2020. By 20th February 2021, it crossed the mark of $1.71 trillion – which is a tenfold increase in less than a year. Bitcoin, dominating more than 60% of the crypto market, follows nearly the same curve.

The pandemic caused an unprecedented boom in the demand for crypto assets like Bitcoin. Trends suggest that the exponential surge is here to stay as investors are increasingly seeking avenues to hedge their assets against the risks present in the traditional inflation-induced money market. Now, whether the number of Bitcoin owners will cross the mark of 1 billion much before 2031 – only time will tell.

How Many People Own Bitcoin?

Due to the fact that the technology is built like it is, no one will ever know exactly. However, since blockchain is a distributed ledger and all information is transparent and shared with everyone, we can crunch the numbers and make some predictions.

The most common method of estimating the number of Bitcoin owners is to look at the amount held in different addresses. Beginning of 2019, in total 460 million Bitcoin addresses held a balance larger than 0.0 BTC. Out of those, 288 million hold no Bitcoin in them at all today. The remaining 172 million represent the Bitcoin addresses that make regular Bitcoin transactions. Out of those, 147 million belong to exchanges, Bitcoin services, merchants, or other kinds of market actors. Only the remaining about 25 million addresses are believed to be economically active wallets that belong to private people on the network.

There are three main fallacies with this method:

- One person can have many addresses and wallets. One person, for example, might have 1 BTC on his iPhone wallet and 0.5 BTC on his laptop. If we treated each address as a person, this would count as two people when it’s really one. Many people own hundreds of addresses and three to ten different wallets.

- Services can hold Bitcoins that belong to many people in a single address. Bitfinex, for example, holds 100,000+ Bitcoins in one address. Bitfinex is a Bitcoin exchange with millions of customers. If we were to treat each individual address as a person, this would be counted as one person, whereas it might as well represent thousands of peoples’ Bitcoins. Below is one of Bitfinex’s wallets – it holds over 6,000 BTC right at any given time.

- Many people don’t move Bitcoins off the exchange. The majority use centralized services and never create their own Bitcoin wallet.

The second common method to estimate the number of owners is to look at exchanges and check the number of accounts. Some exchanges publish their user counts, while others require some guessing, either by looking at their trading volume or by reporting their visitor counts.

There are four main fallacies with this method:

- Inactive accounts: Some customers may open an exchange, buy Bitcoin, and sell it later. This still counts as an account in the exchange’s data, but the account doesn’t actually hold any Bitcoin.

- Other coins: Many exchanges offer other cryptocurrencies. A user could sign up and only buy Litecoin, but not Bitcoin.

- Multiple accounts: A user can have unlimited exchange accounts. One person might have an account with Coinbase, Kraken, and Gemini, for example.

- Faked Accounts: Volume and visitor counts on some exchanges are faked by the exchange to appear bigger than they are.

This leads us to the observation that the total number of people who own Bitcoin depends on the varying definition of “own”. According to glassnode, a blockchain analytics firm, there are around 30 million addresses with any amount of BTC in them.

If owning Bitcoin includes storing ANY Bitcoin in a centralized exchange or wallet, the numbers mentioned above begin to seem reasonable. And the truth is, most owners of Bitcoin likely do store their coins on centralized services. With one study suggesting ~25 million cryptocurrency traders outside the USA & Europe, it seems quite likely there are over 100 million owners of Bitcoin.If the above is true, it can be said that about 1.3% of the world’s population owns Bitcoin

Conclusion:

In the beginning, the Internet was difficult to use, lacking in the areas of user interface (UI) and user experience (UX). As these fields improved, the Internet’s user base subsequently increased. If Bitcoin – and cryptocurrencies in general – continue to improve in terms of the technology they are built on, as well as ease of use, it is reasonable to suggest that increasingly more people will be investing in Bitcoin.

If Bitcoin follows the same growth rate – given its categorical similarity with the Internet – then the number of users who own Bitcoin could cross the mark of 1 billion in the next ten years. Keeping the amount of Bitcoin owned per user aside, there are reasons to believe that Bitcoin would cross the mark of 1 billion users before 2031.

Now do the math on your own to see what that could mean for the price of Bitcoin if in 2021 one BTC hovers around $40.000 with a potential userbase increase of 10X.

At Blocksize Capital we are helping institutional investors to enter the cryptocurrency market, the same way many needed help to get online back in 1997 – because we genuinely believe that the next generation of financial assets will be running on DLT.