DeFi boomtime!

by Marketing Team

Decentralized finance (DeFi) refers to financial services built on public blockchains and smart contracts (mostly on Ethereum). In this article we are going to shed more light on what exactly the criteria for decentralized finance are. We are going to mention the different types and degrees of decentralization before taking a closer look at the current state of DeFi with regard to the total value locked (TVL) in all DeFi protocols reaching an all-time high of $157.06 billion in August 2021.

To get a better overview, let’s start with a brief introduction to the concept of DeFi.

What is decentralized finance?

As the counterpart to CeFi (centralized finance), DeFi epitomizes a decentralized, trustless and permissionless ecosystem offering financial services possibly even beyond the edge of cryptocurrencies. By automating certain functions and transferring the trust layer from intermediaries to software and code on the blockchain, DeFi provides universal access to financial services, as well as making all operations and interactions transparent and permissionless.

Types and degrees of decentralization

When talking about DeFi, there are two main types of decentralization that ought to be considered in order to distinguish between partly and fully decentralized or centralized concepts.

Architectural Decentralization:

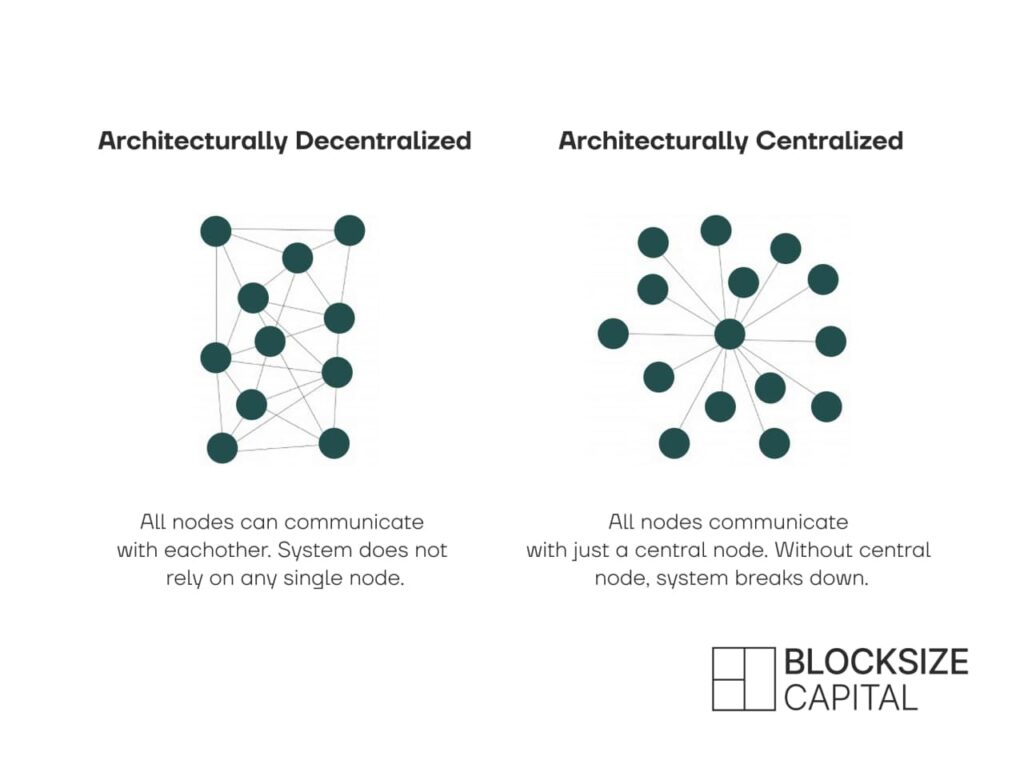

The first criteria for DeFi projects resembles the technical concept behind the financial ecosystem. Hence, it is also considered to be the defining hallmark for DeFi protocols. Architectural decentralization hereby refers to the number of physical nodes (computers connected in a cryptocurrency network) and how they interact with each other. As long as there is no central node the whole system is dependent on and all nodes can communicate with each other instead of the interaction being centrally directed to one (central) node, the architecture of the financial system is classified as decentralized.

Political Decentralization:

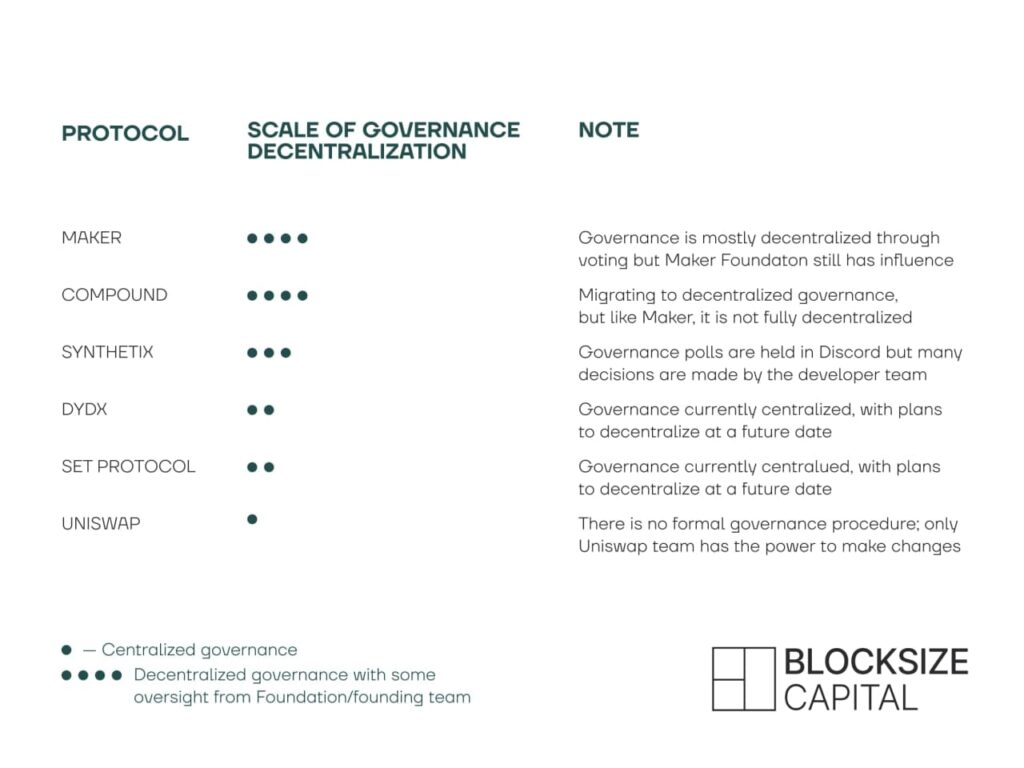

The other main dimension of DeFi, political decentralization, refers to how many entities (individuals or organizations) have control in a financial system. Comparing a voting system on policy changes in countries being ruled by a dictator to democratic countries, the latter are regarded as highly politically decentralized. Politically decentralized DeFi projects remain mostly theoretical, as for instance developers are required to hand over governance and maintenance to stakeholders, which, out of many different reasons, is seen as a practically hard achievement as of today.

On top of the main criteria for DeFi projects, the certain degrees of decentralization also play a significant role in distinguishing between less or more decentralized concepts.

Here we can point out certain aspects that also influence the two main categories mentioned above. Most of these aspects refer to the fields of development, governance, custodial arrangements, price oracle feeds and liquidity provision.

Especially as of today, decentralized finance remains to be seen as a spectrum ranging from fully centralized to fully decentralized, rather than as a checklist with a true or false result.

Why is DeFi so important? What are the key advantages over CeFi?

After having explained how to distinguish between less or more decentralized ecosystems, we can now proceed with the main arguments in favor of DeFi.

The vast potential and biggest flaws of the centralized financial system as of today are now the key objectives in the developments of DeFi projects and decentralization. Considering that the potential of DeFi does not only lie in serving as an alternative to CeFi, DeFi also poses a disruptive framework for financial products and services of the future.

Departing from centralized structures, Defi holds a promise in terms of accessibility to financial applications for emerging economies and can offer complete transparency and autonomy at the same time.

In a direct comparison one can also argue in favor of DeFi due to security, privacy and censorship reasons, as well as because the concepts of DeFi projects are commonly being characterized with an underlying open-source philosophy.

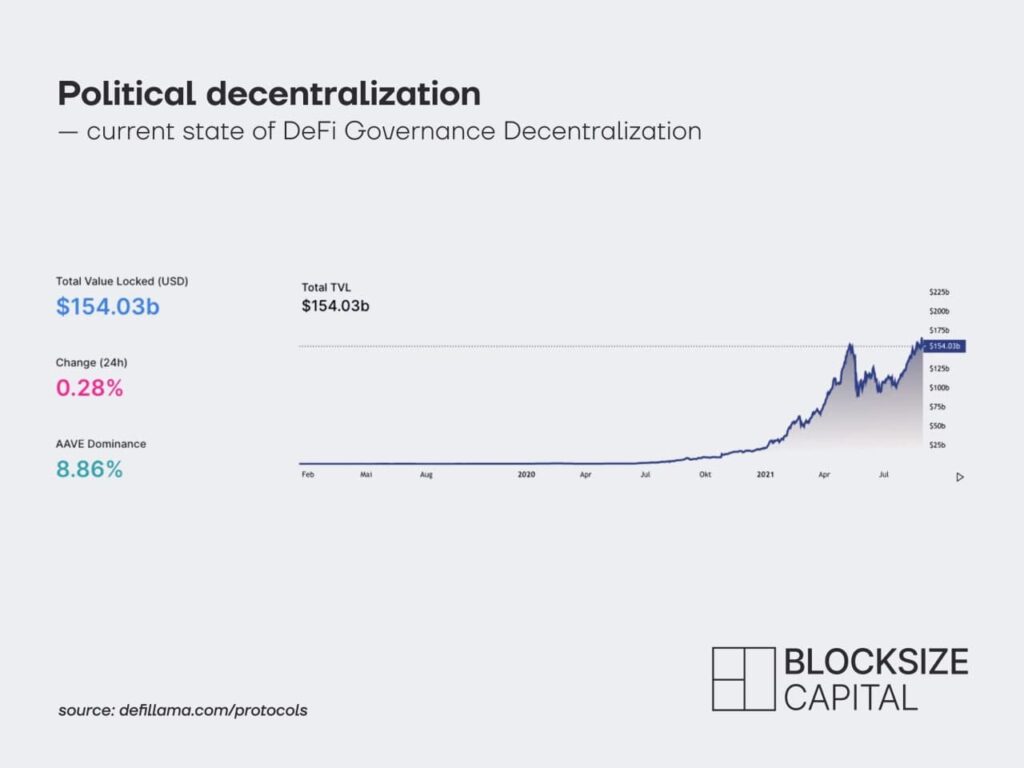

Taking into account that processes and implementation of complete decentralization in finance are much more than only promises for the future, we are already seeing a significant increase of investor attention with more and more new DeFi protocols arriving as of late. Moreover, the TVL in all DeFi protocols has reached an all-time high of $157.06 billion in August 2021. According to various market analysts, the TVL is the best measurement of sentiment within the DeFi ecosystem, and what seems even more interesting, the TVL in DeFi has now surpassed its previous record for the first time – contrary to the development of Bitcoin and Ether (both currently sitting at roughly 24% below their all-time highs).

Although DeFi is still somehow seen as a risky sector, there are already various institutions and venture capitalists entering the market with projects like Aave, Uniswap, Maker and Compound, which are frequently making the crypto-media headlines. In most of these projects there are high degrees of decentralization with very little to some oversight and influence from the founding team.

On the other hand, there are also still some obstacles to get past until DeFi protocols can become the successor of our current financial ecosystem. The development of DeFi is based on continuous reevaluations and modular combinations of stacks of different DeFi layers, but there are still some downsides remaining, also keeping in mind most DeFi projects and structures are only decentralized to a certain extent. The fundamental open-source philosophy attached to the term decentralized finance is going to unfold depending on significant increases in use cases and users.

In addition, DeFi introduces a certain level of smart contract risk. Namely, the smart contracts utilizing DeFi protocols are putting users at risk as attackers manipulated oracle prices of collaterals (DeFi lending platform bZx, February 2020) and price feeds (Synthetix trading platform, 2019), while also finding other vulnerabilities. Limitations such as the speed of blockchain, missing liquidity, or regulatory risks can all be seen as throttling factors to the development, or rather indicators for a missing maturity in a possible disruptive concept, that holds much more than only big promises for the future.

DeFi boom time parted with a disruptive perspective on financial ecosystems of the future

To put things in perspective, DeFi offers a new way of thinking considering the structures underneath financial ecosystems. It offers principles that can also be applied to traditional financial markets, whereas a transition with hybrid versions of DeFi projects is something that we can already see, and expect more of in the near future.

Whether DeFi will pose a disruptive change of the financial ecosystem as we know it today, remains to be seen. One thing that is certain is that the potential and key principles of DeFi constitute an immense value proposition to the fintech world of tomorrow.

Some of today’s circumstances might be unthinkable in a futuristic world of fintech, while hybrid DeFi projects could also pave the way for the future. Regulation and governance have resulted in an enormous proportion of the world being denied access to financial services, which does not mean that DeFi threatens traditional institutions. Instead, DeFi is also providing a chance of collaboration between the crypto community and central banks with a new standard for structures, or even for whole economies. The demand for solutions in the sphere of DeFi is just growing as much as the ecosystem itself.

Blocksize Capital provides a secure and stable infrastructure to assist forward-thinking institutions with strategic financial positioning for the future. Get in touch with us now and confidently step into the new financial era of digital assets with our SaaS solutions and support.