Spezialfonds – Ready, Set, Crypto!

by Marketing Team

This summer, millions and billions of German €’s will be invested in bitcoin & Co.!

Whoo, Whoo, Whoo! Hang on a minute, not so fast.

That opening statement was bold, got off to an early start, it is certainly not true and should NOT be considered financial advice!

But now, that we have your attention, let us tell you why there are possibilities for this event can be considered likely!

On April 22nd, Germany’s federal parliament, the Bundestag, cleared a new legislation, which enables institutional investment funds – the so-called Spezialfonds – to allocate 20% of their balance to crypto-assets. This new law will come into force on July 1st 2021.

This step has been widely seen as a big advantage to Germany’s position as a financial investment hub, and many experts believe it will foster the entire crypto industry by further legitimizing the asset class.“The addition of crypto assets in Spezialfonds is an important step for their acceptance, […]Here, the law is going in the right direction and we expressly welcome it,” – Frank Schäffler (FDP) in an interview with Decrypt.

Before we dive more into details and numbers, we first should explain what Spezialfonds actually are. They are considered the German institutional fund vehicle of choice for most liquid asset classes, and for property within distinct structures. Segmented Spezialfonds allow assets to be managed by different underlying managers with unified reporting under the umbrella of a so-called Master KVG structure. The Master-KVG is a German-regulated investment management company authorized and supervised by the German Federal Financial Supervisory Authority (Bundesanstalt für Finanzdiensleistungsaufsicht, the “BaFin”) and licensed under the German investment law.

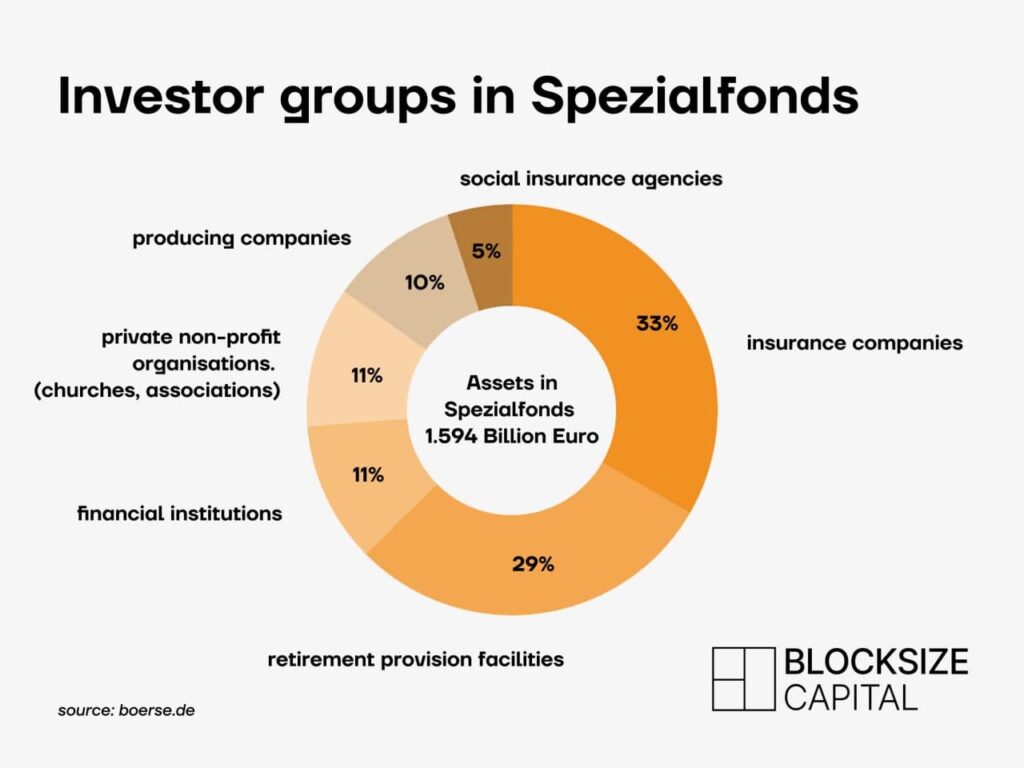

The upcoming law will apply to both existing Spezialfonds and to new ones set up by institutional investors such as financial institutions, insurance companies, and pension funds. With that’s been said, around 4,000 existing investment funds will from July on be eligible to invest in Bitcoin and other crypto-assets.

The news from Germany spread like a wildfire across the globe and many experts and individuals from the financial sector welcomed the decision by the Bundestag.

“This is a massive development considering the fact that institutional investors and corporate entities have not historically thought highly of cryptocurrency. Currently, an increasing number of financial institutions believe Bitcoin is a store of value and an excellent hedge against inflation; this news comes after American investment bank JP Morgan announced it would offer Bitcoin services to wealthy clients.” – Joseph Hagan, Founder of New York-based WealthColony LLC on LinkedIn

To showcase the potential in numbers, around €1.2 trillion ($1.8 trillion) are currently invested into Spezialfonds, with fixed investment conditions, and until now cryptocurrencies are not allowed to be part of the investment strategies.

With the new regulations become law on July 1, and Spezialfonds would choose to place just 1% fund allocation in crypto, an estimated €2.3 billion ($2.8 billion) could enter the cryptocurrency market.

Already blown away? Well, it’s getting even more impressive!

Theoretically, up to €350 billion ($422 billion) could make their way into the crypto market from Spezialfonds. To put things in perspective, Bitcoin’s current market cap alone is $700 billion, just double the potential inflow from Germany.

“This won’t happen overnight, but we are talking about the largest investment vehicle that we have in Germany – literally all the money is in there,” – Sven Hildebrandt, CEO of Distributed Ledger Consulting (DLC)

All excitement apart, this step from the German parliament proves that regulators have a big interest in adapting to cryptocurrencies as investments, to not be left behind, within a fastly developing industry. Bringing new laws into place adds security and trust, especially in a country like Germany, which is very keen on regulatory compliance.

The Federal Association of Alternative Investments called Bundesverband Alternative Investments (BAI) also welcomed the regulatory changes in general.

“In an increasingly digital world, it was imperative for us that investments in crypto values be permitted at least for Spezial-AIFs. In the retail fund area, this must now be accompanied by a change in the UCITS directive (OGAW-Richtlinie),” – Frank Dornseifer, MD at BAI in an interview with Börsen-Zeitung

In its recommendation for a resolution on the Fund Location Act, the Finance Committee of the Bundestag advocated that the direct acquisition of crypto assets for public funds should not be permitted for reasons of investor protection. For these vehicles, participation in the crypto market has so far been possible via derivative products.

The BAI criticizes, however, that the federal government failed to create the conditions for real crypto funds that would be issued via the blockchain in the law on the introduction of electronic securities.

“That would have been a real progress in innovation, which was prevented by poor coordination in the ministries, even though the parliament wanted this,” – Frank Dornseifer in an interview with Börsen-Zeitung

Note: We will cover this topic about blockchain-based securities instead of paper printed certificates in our upcoming blog post.

Now the last question to ask is, will you wait for the Spezialfonds to enter the crypto market and potentially blowing up the entry-level to this market, or will you make a move before the 1st of July?

If you feel ready to make the move, we at Blocksize Capital have the knowledge and infrastructure to help you on your way into the future of investments.